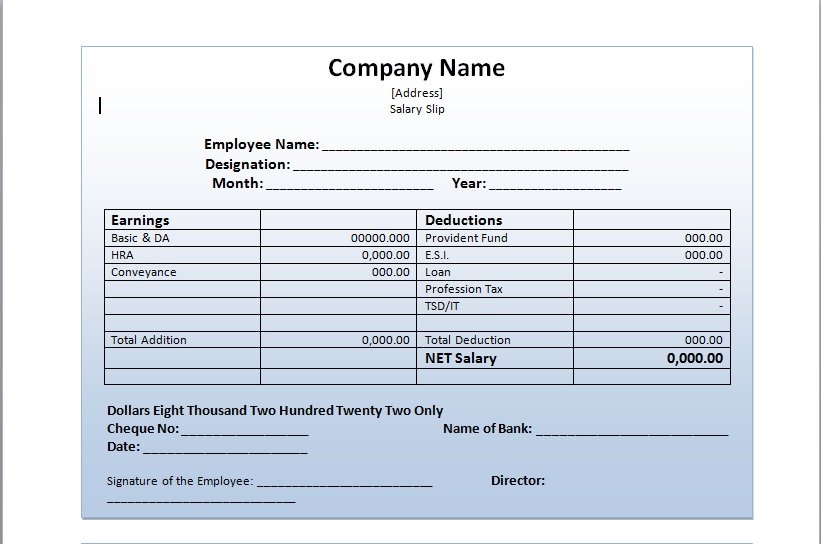

Useful Salary Slip Formulas 1īasic wage + HRA + Conveyance + Medical + Special allowancesĠ.75% of employee gross wage. Step 7: Now take out the printout of the salary slip and sign it and distribute to employees. Step 6: Now subtract all the deductions from the earned gross salary of the employee in that particular month, the balance amount will be the net salary of the employee. Other(Special) Allowances (Balance allowances) HRA (40% of the basic wage for nonmetro cities)Ĭonveyance Allowances ( 1600 Rs in urban areas) Step 5: In another column add deductions such as EPF, professional tax, ESI/health insurance, TDS, salary advances, etc…

Salary calculation formula for the total paid days = (Original gross salary/Total days in the month) X Paid days in that month. The sum of all the earnings will be called the actual gross salary of the employee. Step 4: Now in one column add all the earnings of the employees such as basic wage, house rent allowances, conveyance allowances, medical allowances & special allowances. To calculate total paid days subtract LOPs from the total days in the month. Step 3: Now enter the number of days in the month and the LOPs (Loss of Paydays) of the employee. Step 2: Now enter the employee’s general details like name, designation, department, date of joining, gross salary, bank details, and any other required information as per your choice. Step 1: To create a salary slip/pay slip open a new Excel sheet and write your company name, address, and payslip month & year in the first three rows of the Excel file. Please note, you need to provide the National Insurance Institute, each month, with salary slip mentioning the number of working days and amount of salary. Download Excel How to Create a Salary Slip in Excel

0 kommentar(er)

0 kommentar(er)